SBI Large Cap FUND-REGULAR PLAN GROWTH

SBI Large Cap FUND-REGULAR PLAN GROWTH

Fund Manager : Ms. Sohini Andani, Mr. Pradeep Kesavan, Mr. Saurabh Pant, | Benchmark : BSE 100 TRI | Category : Equity: Large Cap

NAV as on 21-01-2026

AUM as on 31-12-2025

Rtn ( Since Inception )

11.87%

Inception Date

Feb 01, 2006

Expense Ratio

1.47%

Fund Status

Open Ended Scheme

Min. Investment (Rs)

5,000

Min. Topup (Rs)

1,000

Min. SIP Amount (Rs)

500

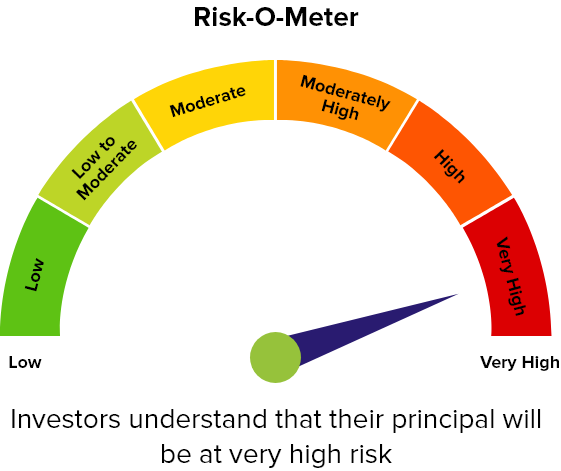

Risk Status

very high

Investment Objective : To provide investors with opportunities forlong-term growth in capital through an active management of investments in a diversified basket of equity stocks of companies whose market capitalization is at least equal to or more than the least market capitalized stock of S&P BSE 100 Index.

Returns (%)

| 1 Mon (%) | 3 Mon (%) | 6 Mon (%) | 1 Yr (%) | 3 Yrs (%) | 5 Yrs (%) | 10 Yrs (%) | |

|---|---|---|---|---|---|---|---|

| Fund | -2.12 | -1.25 | 0.7 | 9.66 | 13.71 | 13.28 | 13.56 |

| Benchmark - NIFTY 100 TRI | -2.92 | -2.76 | 0.29 | 9.86 | 13.45 | 13.11 | 14.68 |

| Category - Equity: Large Cap | -2.94 | -2.97 | -0.78 | 7.8 | 14.05 | 12.74 | 13.48 |

| Rank within Category | 5 | 4 | 6 | 7 | 20 | 9 | 15 |

| Number of Funds within Category | 35 | 35 | 35 | 34 | 32 | 29 | 26 |

Returns less than 1 year are in absolute and Returns greater than 1 year period are compounded annualised (CAGR)

Equity Holdings (Top 10)

| Sector | Allocation (%) |

|---|

Sector Allocation (%)

Asset Allocation

| Asset Class | Allocation (%) |

|---|---|

| Equity | 95.75 |

| Debt | 0.35 |

| Cash & Cash Equivalents | 3.9 |

Portfolio Behavior

| Mean | 14.48 |

| Sharpe Ratio | 0.8 |

| Alpha | 0.85 |

| Beta | 0.88 |

| Standard Deviation | 11.03 |

| Sortino | 1.35 |

| Portfolio Turnover | 21 |

Market Cap Distribution

Yearly Performance (%)

Standard Performance

Riskometer

SIP Returns (Monthly SIP of Rs. 10,000)

| 3 Year | 5 Year | 10 Year | 15 Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scheme Name | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) | Invested Amt | Current Value | XIRR (%) |

| SBI Large Cap FUND Reg PLAN Gr | 360,000 | 417,166 | 10.34 | 600,000 | 802,765 | 11.93 | 1,200,000 | 2,378,576 | 13.29 | 1,800,000 | 5,570,420 | 13.95 |

| NIFTY 100 TRI | 360,000 | 417,246 | 10.38 | 600,000 | 799,382 | 11.79 | 1,200,000 | 2,438,805 | 13.79 | 1,800,000 | 5,358,952 | 13.5 |

| Equity: Large Cap | 360,000 | 413,317 | 9.67 | 600,000 | 795,094 | 11.5 | 1,200,000 | 2,351,832 | 13.04 | 1,800,000 | 5,169,088 | 13.02 |